Unfortunately, this deal has expired 8 August 2023.

*

424°

Posted 5 August 2023

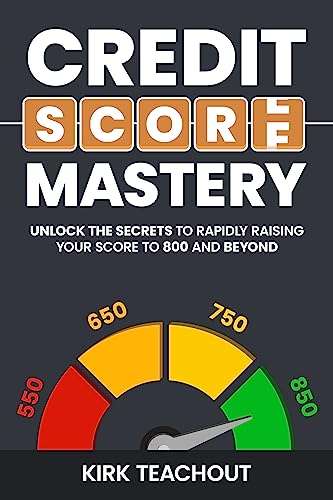

Credit Score Mastery: Unlock the Secrets to Rapidly Raising Your Score to 800 and Beyond - Kindle Edition

Shared by

Wile_E._Coyote

Joined in 2020

26

1

About this deal

This deal is expired. Here are some options that might interest you:

How to build your credit score to upwards of 650… 700… even 800+ with these simple financial habits.Do you know why applying for a credit card can hurt your score? Or how carrying a balance affects your credit in more ways than one?

According to a recent survey from Capital One, these are some of the top “credit myths” that cause people to lower their credit score without even realizing it or understanding why.

It’s not their fault, though. The truth is many institutions make managing your credit more complicated than it needs to be.

In fact, the difference between people with high credit scores and those with lower scores has less to do with their knowledge or how much money they make… and more to do with a particular set of habits they practice on a regular basis.

These are habits that don’t just raise and maintain strong credit scores but also lead to powerful financial security and peace of mind.

This book covers these basic “Habits of Credit Mastery” that the credit elite use to create financial independence for themselves. It breaks down the core components of what makes up your credit score, and shows you how to develop a credit-building routine, one step at a time.

Here are just a few of the “insider secrets” you’ll discover inside this book:

Now you can finally take control of your finances, without the overwhelm of figuring things out yourself. By adopting these Habits of Credit Mastery, you’ll naturally develop the skills and financial understanding that can allow you to kiss your money worries goodbye.

These habits are simple enough that anyone can use them to improve their credit score while setting themselves up for long-term wealth at the same time. So even if you feel behind or uncertain about your future, this book provides a step-by-step roadmap that can help you fast-track your way to financial stability and freedom.If you’re ready to take charge of your financial future and build back your credit for good, then scroll up and click the “Add to Cart” button right now.

According to a recent survey from Capital One, these are some of the top “credit myths” that cause people to lower their credit score without even realizing it or understanding why.

It’s not their fault, though. The truth is many institutions make managing your credit more complicated than it needs to be.

In fact, the difference between people with high credit scores and those with lower scores has less to do with their knowledge or how much money they make… and more to do with a particular set of habits they practice on a regular basis.

These are habits that don’t just raise and maintain strong credit scores but also lead to powerful financial security and peace of mind.

This book covers these basic “Habits of Credit Mastery” that the credit elite use to create financial independence for themselves. It breaks down the core components of what makes up your credit score, and shows you how to develop a credit-building routine, one step at a time.

Here are just a few of the “insider secrets” you’ll discover inside this book:

- 7 of the basic financial habits that people with “exceptional” credit use to achieve and maintain scores of over 800+. (This surprisingly has very little to do with how much you make and revolves around what you do with your money)

- How having more than one credit card can help you build your credit - and how to know when to stop applying for new accounts

- The 4 key mistakes to watch out for when checking your credit report. (These mistakes may seem small, but if they go unnoticed long enough, they could potentially have severe consequences on your financial life)

- 9 of the worst financial moves that send people’s credit plummeting, plus what you can do to prevent your credit from taking a hit.

- How to adopt the beliefs of the “credit elite,” and how this differs from the average adult. (This ultimately comes down to the same fundamental principles of money management. There aren’t any hacks necessarily, just certain ways of understanding how money works)

- The 5 most critical factors that determine your credit score, and techniques you can use to improve each aspect of your score (The top factor alone accounts for over a third of how credit agencies calculate your rating)

- How to check your credit report for free. (And why you should make a habit of regularly comparing credit reports from different agencies)

- 9 step-by-step exercises to help you apply the key Habits of Credit Mastery to your own life. (These are designed to be easy and straightforward enough for anyone to use, without any financial jargon or complex calculations. As long as you follow the steps, this can help keep you on track to building back your credit)

Now you can finally take control of your finances, without the overwhelm of figuring things out yourself. By adopting these Habits of Credit Mastery, you’ll naturally develop the skills and financial understanding that can allow you to kiss your money worries goodbye.

These habits are simple enough that anyone can use them to improve their credit score while setting themselves up for long-term wealth at the same time. So even if you feel behind or uncertain about your future, this book provides a step-by-step roadmap that can help you fast-track your way to financial stability and freedom.If you’re ready to take charge of your financial future and build back your credit for good, then scroll up and click the “Add to Cart” button right now.

Community Updates

Edited by a community support team member, 5 August 2023

37 Comments

sorted byI bought a book on eBay called "How to Scam on eBay". It still hasn't arrived.

Steer well clear of HUKD.

Top 3 tips going by some of the comments on here.

"Don't want or need it but, buying another Kindle anyway, At that price!"

I hope nobody is wasting money to pay for this either. (edited)

Numbers are notional. What’s actually on your credit file is what matters.

Don’t knock your debts, don’t max out your credit lines & pay stuff on time.

You’re welcome.

This time last year my credit rating was poor after some CCJ a few years earlier. We hit a financial wall, I did still pay them off eventually but obviously they are no longer on my file.

August last year was huge as it meant we passed the credit checks for our house purchase in October. Now, in the middle of a cost of living crisis we are richer than we have ever been - makes no sense really.

Lessons learnt about not paying debts!

Borrow less. Debt is enslavement.

That's how they get you.

OK.

Oops we've reduced your score because you applied for a credit card.

Oops we've reduced your score because you used your new credit card and have a balance on it.

scores are meaningless.

Before getting a mortgage I worked aggressively to increase my credit score and applied for a credit card just for that, actually starter about 3 years before. Paid everything off monthly, applied for a different card cos the credit limit wasn't budging, electoral roll etc. Checked my credit score on multiple apps, was a bit fun watching the number jump around nonsensically.

I don't like credit cards and didn't want one, I was happy budgeting on my Monzo but I thought it was needed.

Turns out, a mortgage is a 'secured' loan, and a higher credit score does not matter one bit. As long as there isn't anything negative on my file (which there wasn't, as I never had a credit card or missed any payments before), it really didn't matter.

Got the mortgage, would've gotten the mortgage if I did nothing to improve my 'default' score. I guess I can get a good rate on car finance now? If that's how it works? No interest in financing a car ever. Don't have that sort of income.