Unfortunately, this deal has expired 5 minutes ago.

*

3185°

Posted 9 January 2024

80% off Final Value Fees for up to 100 listings when you opt in (excludes 30p order-level fees) - selected accounts

Shared by

Chanchi32 Deal editor

Joined in 2013

7,163

107,837

About this deal

This deal is expired. Here are some options that might interest you:

80% off eBay Sellers fees offer from 12/01, opt in if eligible

If not eligible try the 70% offer

What's it all about?

You can take part in the promotion on eBay.co.uk. Eligible sellers will receive an email with the RSVP link to the offer. You must opt in to the promotion by clicking on this link before any of your 100 listings start.

Anything else I need to know?

Who can take part?

If not eligible try the 70% offer

What's it all about?

- Get 80% off variable percentage final value fees ("FVF") per listing in final value fees if the item sells and pay no insertion fee.

- A fixed order level fee of 30p and other fees, including any International fees, still apply.

- Promotion is valid for up to 100 listings on eBay.

- Listings must start during the promotional period.

- Listings can be auction-style or fixed price format.

- The promotion start and end dates are included in the email we send to invited sellers.

- Items must sell within the first listing period.

- Sounds good, where do I find the promotion and how do I sign up?

You can take part in the promotion on eBay.co.uk. Eligible sellers will receive an email with the RSVP link to the offer. You must opt in to the promotion by clicking on this link before any of your 100 listings start.

Anything else I need to know?

- eBay charge an FVF when your item(s) sell(s). The FVF charged per order consists of: (i) a variable portion (“Variable Portion FVF”) which is calculated as a percentage of the Total Sale Amount; and (ii) a fixed portion (“Fixed Portion FVF”) for example 30p. The Total Sale Amount means the amount the buyer pays for an order, including the item price, postage, taxes and any other applicable fees.

- The FVF Discount in this promotion applies to the Variable Portion FVF (net of any other discounts) in respect of the eligible items’ Total Sale Amounts. For example, if you would have been charged 12.80% on the Total Sales Amount, the 80% FVF discount will reduce this to 2.56%. The Fixed Portion FVF (e.g. 30p) will not be discounted. Therefore, the fixed charge of 30p per order will still apply.

- You won't pay an insertion fee for each of the 100 listings. Listing upgrade fees will still apply and will be charged according to the eBay fees policy.

- You may also be subject to International fees.

- The number of listings eligible under this promotion may be less where seller restrictions apply. Click here to learn more about selling allowances.

Who can take part?

- This Promotion is open to all registered Private Sellers who (a) have been invited to take part, (b) are registered to managed payments, and (c) have actively opted in (“Eligible Sellers”). If you have not registered for managed payments you will be prompted to update your details after you opt-in to the Promotion.

- Participation is linked to the seller's account and is not transferable.

- Eligible Sellers’ accounts must meet eBay minimum seller performance standards.

- Please sign in to My eBay and view your seller standards dashboard to verify whether your account is currently meeting the standards. The seller standards dashboard is available to all sellers here.

- If you registered after 15 March 2011 or haven't listed any items for a while, you may have a listing allowance of 10 items per month or of £650 per month, whichever is reached first. You may be able to increase this allowance by providing additional verification.

- An eligible item previously scheduled to go live during the promotional period will qualify for the promotion only if you have opted in to the promotion before the listing starts.

- If an item that is eligible for the promotion had previously closed without a successful sale and is re-listed during the promotion period, it will form a part of the 100 listings limit of the promotion.

- You will not receive a refund of your original insertion fee if the item sells.

- Listings do not have to successfully sell during the promotional period to be eligible.

- If an item qualifies for the promotion and when the item sells, the invoice will indicate the fee including the discount. Please note: if the item does not sell the first time and if you relist it after the promotional period or if it is automatically relisted during the promotional period, standard final value fees will be charged according to the eBay fees policy when the relisted item sells.

- Items that are automatically relisted through the Automatic relist function or the Good 'Till Cancelled function will be charged.

- Only single quantity listings are eligible.

- For items listed in 2 or more categories, only the insertion fee for the first category is included. Standard insertion fees will be charged for listing the same item for each additional category, according to the eBay fees policy.

- Free listings in this promotion do not count towards your monthly 1000 free listings.

- Your first listing period may vary and is dependent on the listing format you choose (e.g. – auction-style vs buy-it-now), the duration of the listing you choose and the listing experience you use. The first listing period will be considered to have been ended when the listing you create first renews or relists.

Community Updates

Edited by Chanchi32, 12 January 2024

614 Comments

sorted by2. Unless you're 'trading' selling your old stuff isn't taxed

3. Only sales over c£1,700 or more than 30 items a year are reported" Quoted MSE

Go to the HMRC Website

Click "CHECK NOW"

Select "SOLD GOODS OR SERVICES" and hit "CONTINUE"

If you are only selling used, personal possessions, select "YES" and hit "CONTINUE"

If you haven't sold a personal possession for £6,000 or more, select "NO" and hit "CONTINUE"

That should tell you what you need to know!

If you are selling personal possessions for £6,000 and over and made a profit, I think it's Capital Gains Tax you are supposed to pay.

Don't take this as gospel, but it it's straight from the HMRC website.

From what I can gather, the up to £1000 figure that keeps getting mentioned, is aimed at those buying to sell on eBay or making/crafting things to sell for profit. (edited)

The 1k profit limit is for trading. If you are wilfully and openly trading, you can make 1k before paying tax. It doesn't mean you can't sell your old stuff.

Selling your old wanted stuff doesn't count as trading so the "profit" thing doesn't apply. If someone buys your old crap for more than you paid for it, it doesn't automatically make you a trader or business in the eyes of the HMRC. The only exception is capital gains tax for individual sales over 6k

They will be looking for people not doing tax returns but turning over large sums and selling multiple brand new items etc.

They won't just force anyone who's sold 30 items to register as a self employed business and pay a tax return.

It's worth bearing in mind they have employed 26 staff for this and yet there are millions of sellers on ebay, vinted, etsy etc not to mention this will apply to foreign sellers selling on UK platforms not to mention they will be working with airbnb etc.

Just because your data gets sent over doesn't mean anyone will ever look at it. A computer algorithm will probably decide likely candidates for human review but again, just because your data gets sent across doesn't automatically mean it will be looked at by a human let alone acted on.

IMHO the biggest aim of this was to scare undeclared traders into paying income tax, but it's obviously having the side effect of scaring normal people. Another GOV shambles, basically.

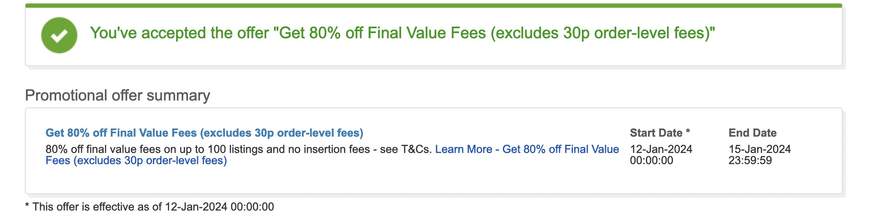

This link should work, or check your offers on selling overview to activate it

rsvp.ebay.co.uk/rsv…mAE

The 2 links below are ALL you need to know, no need to speculate, it's all crystal clear below:

gov.uk/che…tax

gov.uk/gov…eet

Goods being sold as "New" - As far as I'm aware, you could sell £1000 worth per year without having to declare yourself to HMRC.

The main one being buy to sell stuff which you had a £1000 per year allowance on?

But thanks OP for posting up ..

Sometimes when there's known disruption such as royal mail strikes, they will remove your late defects.

Also if you use a fully tracked service and it was clearly dispatched in time, and the delivery fell outside the couriers estimate, it sometimes automatically gets removed.

The ones that always seem to stick are when you fail to mark the item as despatched on time (even if it gets delivered on time) and when a buyer says the item was late when they leave feedback.

The safest way is to always mark as dispatched within your stated time frame.

It can also be advisable to avoid buying your postage directly through eBay, this way the tracking number won't be automatically added, so late deliveries won't be automatically reflected. (And if the buyer asks for the tracking number you can just provide it via ebay messages) you can always add the tracking number to ebay if/when you can see it was delivered inside the quoted time frame (and don't add the ones that were late)

Not much you can do about a buyer saying it was late when leaving feedback apart from always making the effort to dispatch quickly. Only a small portion leave feedback these days though so it's a minor issue.

Avoiding overdue dispatch and buying postage off-site should get the number of late defects down.

80% - Unfortunately, you can no longer sign up......

70% - Unfortunately, this promotional offer is by invitation only.....

But I look forward to all of those people who couldn't use the links before midnight and who can all now use it...

"Hi, big tax dodging corporation. Would you like to help us collar people who owe a tiny fraction of what you do?"

"SURE!!!"

BFFs!!!

independent.co.uk/life-style/hmrc-tax-side-hustle-online-sellers-ebay-b2474542.html "It is advised that people earning below the £1,000 threshold may not have to fill in a tax return, but should keep records in case they are asked for them."

Keep your receipts as proof your making loss on anything you sell in the future funny thing is ebay amazon etc still only pay £1 million in tax on billions income ?

I read students are up in arms due to them buying stuff cheap from charity shops and then selling on vinted to help with their studies. I guess they will all now need to keep their original receipts too, probably better off working 5 hours a week instead at local shop they can earn £12570 before tax.

£1000 worth of stuff to sell

They do tend to be a bit flakey at the start of the year, though.

And also, it's widely debated, but I have personally seen it only become active on the actual Friday. Sometimes it's like this for individuals but now and then over the past few years, it didn't work for anyone on a Wednesday but the emails still come on the Friday...Guess we'll find out soon.

Maybe they will go to once per month?

Nobody really knows.

You'd think they'd do everything they could to keep people keen, though.

Especially after the recent HMRC news was handled so disastrously and has people running scared thinking they will have to do a tax return if they sell 31 unwanted personal items. Not even Martin Lewis has managed to reassure people.

vm.tiktok.com/ZGejoP4Yd/ (edited)

Anyway, put my bits on FB Marketplace and sold on there instead.

Still annoying not to be offered though

Have plenty of christmas stuff i need to sell!

If you're not in now, you're not going to be.

But hey, if people say it'll suddenly burst into life Friday, excellent. (edited)

It's up to you how you proceed, the person contacted them and HMRC said it's best not to ignore the letter, it doesn't go away. That said I know a few people who would also fall into the bracket with no letter. Also ebay have been reporting peoples sales for years, nothing new. The only reason people worry about it is HMRC do an annual campaign to make you aware. Given the gov wants to do a tax cut, yeah they'll prob pick more people this year but remember their resources are very limited. That said tightening the tax for huge companies like Amazon instead of threatening people who are trying to make a few quid to pay bills would go down alot better and likely get them far more money.

Looking at some of the comments, their tactic is working with some people scared to sell even when they get the 80% off fees. If you are selling of your own stuff you're likely making a loss, that be offset in the rare chance you're picked from the hat.

channel4.com/new…tax

Cheers

For anyone struggling to claim this, you should try again on Friday

It'll be interesting to seehow this impacts places like eBay and Vinted - far too much scare mongering and anger at the HMRC greed will just turn people away from using those sites, it's stress no one needs. they should either be focusing on people who actually make a living buying and selling, or going after the rich who avoid paying their taxes.