Unfortunately, this deal has expired 2 minutes ago.

*

1081°

Posted 4 December 2023

UK Breakdown Vehicle Cover (New Customers) + £20 Giftcard - £5 monthly (Cancel with 30 days Notice) or £39 Annual (12 months Fixed)

Free ·

Shared by

Random1234 Super Poster

Joined in 2017

3,532

2,121

About this deal

This deal is expired. Here are some options that might interest you:

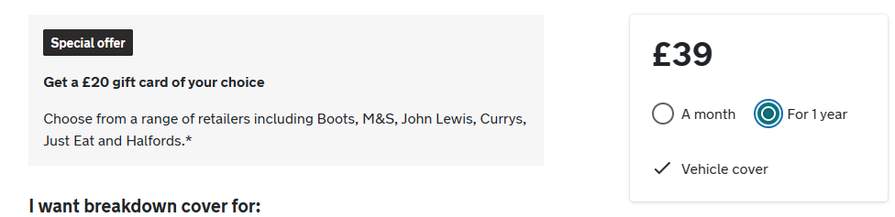

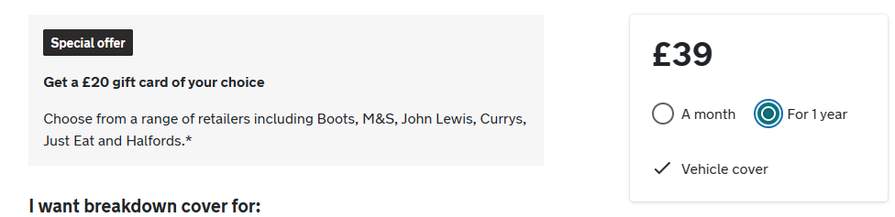

Get a £20 gift card of your choice, including Boots, M&S, John Lewis, Currys, Just Eat and Halfords when you buy AA Breakdown Cover from £5 a month or £39 for a year

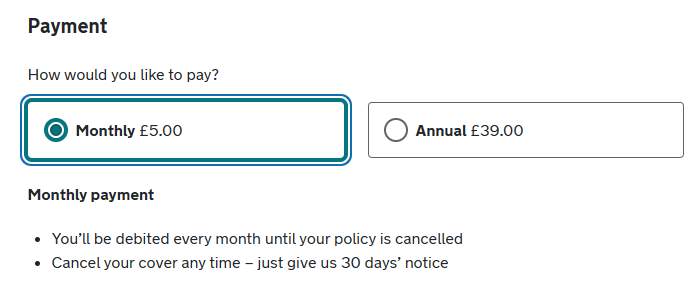

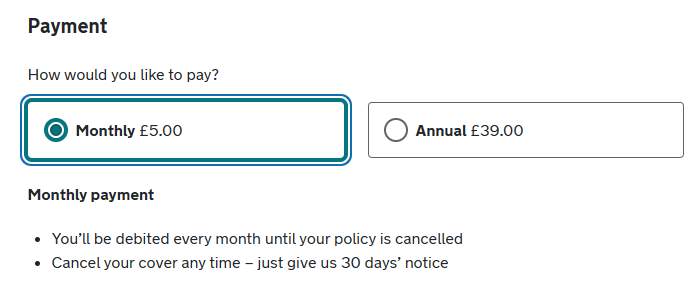

If you pay £5 monthly, you will get £20 Gift Voucher within 120 days + 30 days notice period, hence the total cost for the deal is £20 (effectively Free if you cancel after 4 months)

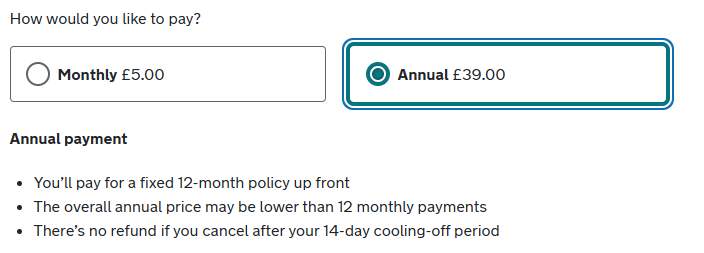

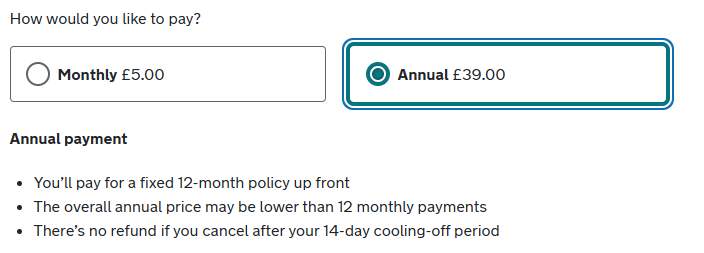

If you pay £39 Annual, you will get £20 Gift Voucher within 6 weeks (effectively £19 for a year)

- Vehicle Cover

- OP price is for Roadside Assistance - 24/7 help by the roadside (over 1/4 mile from home). If we can’t fix the vehicle we’ll tow you to a nearby garage.

Full Terms & Conditions

*Get a £20 gift card of your choice when you buy UK breakdown cover

Offer for new customers only

This offer will be fulfilled on behalf of the AA by a third party (Love to Shop). You can choose from a range of retailers including Boots, M&S, John Lewis, Currys, Just Eat and Halfords.

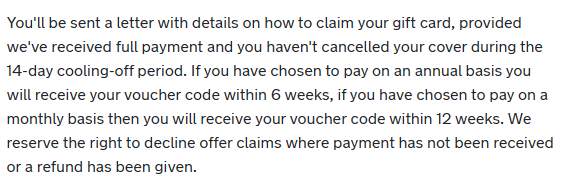

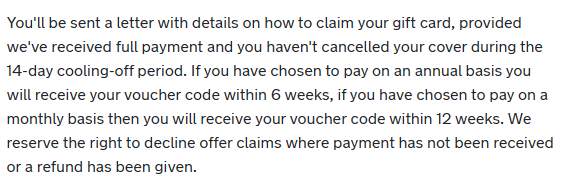

You'll be sent a letter with details on how to claim your gift card, provided we've received full payment and you haven't cancelled your cover during the 14-day cooling-off period. If you have chosen to pay on an annual basis you will receive your voucher code within 6 weeks, if you have chosen to pay on a monthly basis then you will receive your voucher code within 12 weeks. We reserve the right to decline offer claims where payment has not been received or a refund has been given.

Offer is not available for existing Members or at renewal. Offer is not available in conjunction with any other offer or in a breakdown situation. This offer is available to UK residents only; 1 claim per membership only. There is no cash alternative and the AA reserves the right to withdraw or alter this promotion without prior notice at any time.

About your quote

1 Prices shown include insurance premiums payable to the insurer(s) and a fee payable under a separate contract between you and Automobile Association Insurance Services Limited (AAIS) for arranging and administering your cover. Please see the terms and conditions for more information.

Private and domestic use only

Please do not buy this cover for any vehicle used for any commercial purpose, such as:

If you try to use this policy for a vehicle that’s used for commercial purposes, we may not be able to help or may have to charge a service fee.

For any commercial use, you'll need our Business Breakdown Cover.

Breakdown not routine maintenance

This cover provides emergency assistance when a vehicle suffers a sudden or unexpected mechanical or electrical fault that prevents it from being driven or continuing a journey safely.

It does not cover cosmetic, non-emergency, self-induced faults or where we suspect third-party interference. Please do not try to use it as a replacement for routine servicing, maintenance, or repairs, or to cover faults caused by actions or omissions of the driver.

If you try to use this policy for a vehicle that has not been serviced or maintained appropriately, we may not be able to help or may have to charge a service fee.

Roadworthy and road-legal vehicles only

This cover provides assistance for vehicles that are roadworthy and road-legal. It does not cover vehicles that are unsafe, unroadworthy, unlawful, overladen or being used improperly.

Throughout the life of the policy, please ensure that vehicles are serviced annually (or following manufacturers’ guidelines), are maintained in line with manufacturer guidelines, are in good condition and safe to be driven on the road. Please also ensure that vehicles are taxed, insured and have a valid MOT certificate.

If you try to use this policy for a vehicle that’s not roadworthy or road-legal, we will not be able to help you get back on the road.

Repeat call-outs and pre-existing conditions are not covered

Assistance cannot be provided if we have attended your vehicle and you call us out for the same fault within 28 days, unless you can provide proof that a permanent repair has been completed by a garage. Please arrange for a permanent repair to be made following a temporary repair carried out by us.

Cover will not be provided for any known faults that existed before you purchased cover, so please do not try to claim for them. If you try to use this policy for a vehicle with a known fault or still has a temporary repair, we may not be able to help or may have to charge a service fee.

Covered vehicles and drivers

The policy covers vehicles that are up to 3.5 tonnes (3,500kg) in weight and up to 8 foot 3 inches (2.55m) wide.

Please do not use breakdown cover for vehicles that are heavier than 3.5 tonnes or wider than 2.55 metres. Assistance cannot be provided for vehicles that have been vandalised or subject to malicious damage, as these are insured events usually covered by motor insurance.

If you have a vehicle-based policy, then the vehicle registered with the AA is covered for all drivers.

If you change your vehicle, please ensure that you update us promptly.

If you have a personal-based policy (single, joint, family) then a vehicle is covered only if the member is a driver or passenger in that vehicle when it breaks down. Assistance cannot be provided if drivers or passengers are abusive or uncooperative.

Experiencing money worries?

If your current situation is affecting how you manage your finances and you require additional help or support, call us on 0800 262 050.

Assumptions

Your quote is based on the following details:

If you live in the Channel Isles or Isle of Man, or need cover for other situations, call us on 0800 294 6715.

If you have a fleet of vehicles, you need business cover.

If you pay £5 monthly, you will get £20 Gift Voucher within 120 days + 30 days notice period, hence the total cost for the deal is £20 (effectively Free if you cancel after 4 months)

If you pay £39 Annual, you will get £20 Gift Voucher within 6 weeks (effectively £19 for a year)

- Vehicle Cover

- OP price is for Roadside Assistance - 24/7 help by the roadside (over 1/4 mile from home). If we can’t fix the vehicle we’ll tow you to a nearby garage.

Full Terms & Conditions

*Get a £20 gift card of your choice when you buy UK breakdown cover

Offer for new customers only

This offer will be fulfilled on behalf of the AA by a third party (Love to Shop). You can choose from a range of retailers including Boots, M&S, John Lewis, Currys, Just Eat and Halfords.

You'll be sent a letter with details on how to claim your gift card, provided we've received full payment and you haven't cancelled your cover during the 14-day cooling-off period. If you have chosen to pay on an annual basis you will receive your voucher code within 6 weeks, if you have chosen to pay on a monthly basis then you will receive your voucher code within 12 weeks. We reserve the right to decline offer claims where payment has not been received or a refund has been given.

Offer is not available for existing Members or at renewal. Offer is not available in conjunction with any other offer or in a breakdown situation. This offer is available to UK residents only; 1 claim per membership only. There is no cash alternative and the AA reserves the right to withdraw or alter this promotion without prior notice at any time.

About your quote

1 Prices shown include insurance premiums payable to the insurer(s) and a fee payable under a separate contract between you and Automobile Association Insurance Services Limited (AAIS) for arranging and administering your cover. Please see the terms and conditions for more information.

Private and domestic use only

Please do not buy this cover for any vehicle used for any commercial purpose, such as:

- Carrying items/people for money

- Delivery or collection of goods

- Transporting passengers

- Carrying equipment, tools or materials

- Moving vehicles for trade purposes, vehicles used for sporting events, or any combination of private, domestic and commercial use

If you try to use this policy for a vehicle that’s used for commercial purposes, we may not be able to help or may have to charge a service fee.

For any commercial use, you'll need our Business Breakdown Cover.

Breakdown not routine maintenance

This cover provides emergency assistance when a vehicle suffers a sudden or unexpected mechanical or electrical fault that prevents it from being driven or continuing a journey safely.

It does not cover cosmetic, non-emergency, self-induced faults or where we suspect third-party interference. Please do not try to use it as a replacement for routine servicing, maintenance, or repairs, or to cover faults caused by actions or omissions of the driver.

If you try to use this policy for a vehicle that has not been serviced or maintained appropriately, we may not be able to help or may have to charge a service fee.

Roadworthy and road-legal vehicles only

This cover provides assistance for vehicles that are roadworthy and road-legal. It does not cover vehicles that are unsafe, unroadworthy, unlawful, overladen or being used improperly.

Throughout the life of the policy, please ensure that vehicles are serviced annually (or following manufacturers’ guidelines), are maintained in line with manufacturer guidelines, are in good condition and safe to be driven on the road. Please also ensure that vehicles are taxed, insured and have a valid MOT certificate.

If you try to use this policy for a vehicle that’s not roadworthy or road-legal, we will not be able to help you get back on the road.

Repeat call-outs and pre-existing conditions are not covered

Assistance cannot be provided if we have attended your vehicle and you call us out for the same fault within 28 days, unless you can provide proof that a permanent repair has been completed by a garage. Please arrange for a permanent repair to be made following a temporary repair carried out by us.

Cover will not be provided for any known faults that existed before you purchased cover, so please do not try to claim for them. If you try to use this policy for a vehicle with a known fault or still has a temporary repair, we may not be able to help or may have to charge a service fee.

Covered vehicles and drivers

The policy covers vehicles that are up to 3.5 tonnes (3,500kg) in weight and up to 8 foot 3 inches (2.55m) wide.

Please do not use breakdown cover for vehicles that are heavier than 3.5 tonnes or wider than 2.55 metres. Assistance cannot be provided for vehicles that have been vandalised or subject to malicious damage, as these are insured events usually covered by motor insurance.

If you have a vehicle-based policy, then the vehicle registered with the AA is covered for all drivers.

If you change your vehicle, please ensure that you update us promptly.

If you have a personal-based policy (single, joint, family) then a vehicle is covered only if the member is a driver or passenger in that vehicle when it breaks down. Assistance cannot be provided if drivers or passengers are abusive or uncooperative.

Experiencing money worries?

If your current situation is affecting how you manage your finances and you require additional help or support, call us on 0800 262 050.

Assumptions

Your quote is based on the following details:

- You’re driving a roadworthy car, motorbike, van, motorhome or minibus

- Your vehicle is taxed and has an up-to-date MOT

- Your vehicle has a maximum weight of 3.5 tonnes (3,500kg)

- If you have a caravan or trailer attached to your vehicle, it also has a maximum weight of 3.5 tonnes (3,500kg)

- Your vehicle, caravan or trailer has a maximum width of 8ft 3in (2.55m), excluding mirrors

If you live in the Channel Isles or Isle of Man, or need cover for other situations, call us on 0800 294 6715.

If you have a fleet of vehicles, you need business cover.

Community Updates

Edited by Random1234, 4 December 2023

You may also like

Related Discussions

Related Categories

118 Comments

sorted byTbf I've had to call them twice for my old car and they've been great, and the renewal offer was £29 again. Not saying it's a bad deal, it's not, just saying what worked for me.

Just for context - I've had another issue in the past but last week, my wife's car completely died (as in, no electrical power let alone mechanical) on the middle lane of a roundabout on a dual carriageway exit (so very busy and potential for fast traffic), the AA app directed her to phone for immediate assistance as she was in a dangerous situation, but the "priority emergency assistance" number she was given wasn't answered for half an hour (in fact, a couple of helpful workmen used their van as a shield and pushed the car to the roadside for her, and a family member went to help her so they gave up on the AA).

To me, this is inexcusable, they might get high call volumes in bad weather, but if they can't even answer the call within half an hour, they're not investing enough in their infrastructure etc.

Incidentally, never had a problem with any other breakdown service I've used (mainly Britannia and RAC) - I'm not a "serial complainer"!

Just about to take out cover with Green Flag I think.

- At home

- National recovery

- Onward travel

Er . . . there's not a *whole* lot left!

I guess they'll try to fix the car and, if that fails, a tow to the nearest garage.

So if you break down on your way to the airport, this cover may not help you as onward travel is not included. (edited)

They try to take you to a Halfrauds garage.

I believe AA sold theirs to them.

Must be getting some kickback for it

thanks to this deal, I’ve set a reminder to try and chase it up on the phone!

40% off breakdown cover packages is only available when you take out a new Membership with At Home, National Recovery or Onward Travel on theAA.com, versus the prices available via theAA.com between 2 November and 19 November 2023.

The sale starts on 20 November 2023 and ends at 11.59 pm on 6 December 2024. (edited)

Recently needed a heater matrix, expansion tank and fluids, bill was £690 but the AA covered £500 of it, paid for itself.

Now I self-cover (savings) and did get the extra garage cover reimbursed.

Never used the cover but after 6 months into it they do start contacting you offering you to upgrade with add-ons.

I clicked on the vehicle cover & then At Home - price jumps up to £89 & adding National Recovery the price jumps up to £129! & I presume that only covers one vehicle?

Sorry to be thick but what does the basic £39 option cover then?

We have two cars & two drivers - what would be the best option/deal for us & with whom?

Many Thanks!

We're in a similar position to yourself - 2 people driving 2 vehicles. Personally, from a cost perspective, we couldn't find anyone else that gets close to AutoAid's cost (use topcashback and check groupon etc aren't dong a deal).

I've been with them for years, had a recent call-out and the service was exemplary so I'd say not to be discouraged by the fact the product utilises a network of 3rd party recovery firms.

I have always assumed that it’s a 12 month contract or you leave with a penalty.

EDIT: just seen the post fully - apologies - it does say that you can leave (edited)

I thought insurance companies were no longer allowed to offer better offers to "new" customers than existing customers. This is effectively breakdown insurance.

Be careful on renewal as others say, auto renewals should be illegal.

This was a deal.

hotukdeals.com/dea…996

Have I missed it? I’ve selected all the options can’t see anything below 129 squid (edited)